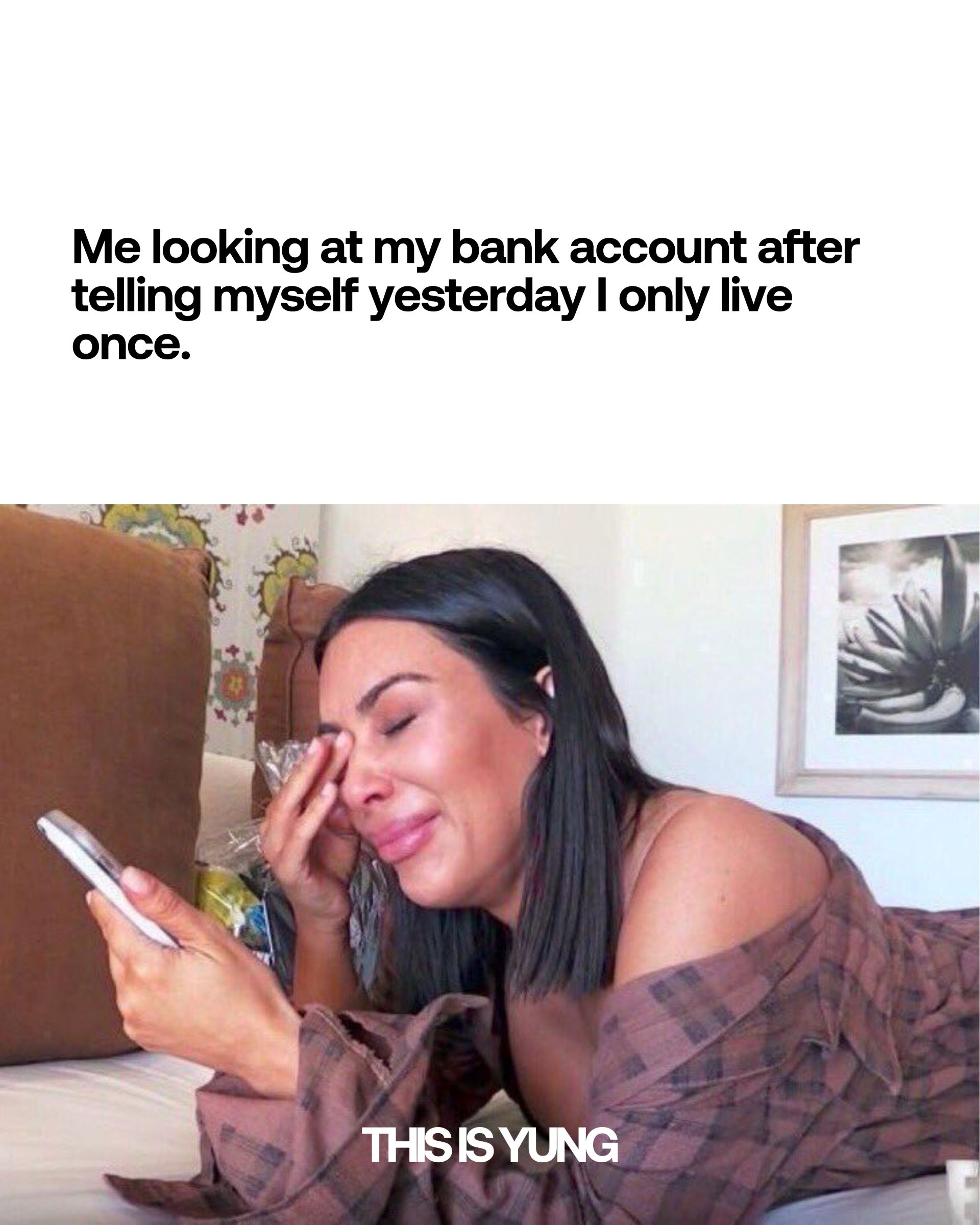

It’s payday Friday. Your friends are texting, the group chat is alive with “where are we meeting?” and you’ve promised yourself that this month will be different. You’ll resist the pull of late-night cocktails and taxis across town. But come Monday morning, your bank app tells a different story.

You’re far from alone. According to a new Ally Bank survey, 3 in 5 millennials and Gen Zers say spending on social activities with friends is directly impacting their financial goals. In fact, overspending isn’t the exception – it’s the rule. Only 18% of young adults say they stick to a strict budget for hanging out with friends, leaving the vast majority caught in a cycle of “it’s only money” until reality bites.

According to the Ally Bank report, the average young adult spends around $250 a month on socializing. Over six months, the median spend is $750, though men report an average of $1,775 compared to $1,250 for women. The same report found that 44% have skipped major social events because of cost, while 25% admit social spending makes saving difficult. Women feel the pressure most acutely: almost 30% say nights out hurt their ability to build savings, compared with 22% of men.

This isn’t just about money, it’s about connection. The Ally Bank survey revealed that 69% of Gen Z and millennials still prioritize seeing friends in person at least weekly, despite the financial strain. For some, the cost of skipping out feels higher than the price of entry. As The New York Post put it, one in four young adults would rather be broke than friendless.

So where does this leave us? On one hand, long-term financial security demands discipline. On the other, you won’t look back fondly on the nights you stayed home checking your balance. Perhaps the smarter approach isn’t about sacrifice but about strategy: setting a social budget you actually stick to, trading a €50 dinner for a picnic, or saying yes only to the nights that matter.

Because in the end, memories and money aren’t enemies. The sweet spot lies in spending with intention, ensuring that the nights out you’ll remember don’t come at the cost of your next holiday – or your peace of mind.

For more takes on culture, visit our dedicated archives.